When strategy lacks structure, product can lead

Using strategic frameworks to create organisational direction

The kernel of good strategy

In his book Good Strategy/Bad Strategy, Richard Rumelt lays out how most organisations fail to create strategies, let alone follow one. He states that the kernel of good strategy consists of three elements: diagnosis, guiding policy, and coherent actions. Let’s look at each of these in turn.

Diagnosis

The first step in creating a strategy is for company leadership to diagnose their current situation in the marketplace. A good diagnosis assesses the challenges facing the organisation and puts them into context. It focuses the mind on the key aspects of the company’s circumstances and prospects.

The first step toward effective strategy is diagnosing the specific structure of the challenge rather than simply naming performance goals. - Richard Rumelt, Good Strategy, Bad Strategy

Guiding policy

A guiding policy describes the approach that the organisation will take to deal with or overcome the issues identified in the diagnosis. A good guiding policy will call out leverage or advantages the organisation can use.

Coherent actions

The coherent actions implement the guiding policy. These are the steps or experiments the organisation will carry out in order to meet its goals, based on the opportunities and constraints of the diagnosis.

Using the kernel

When putting together a product strategy, it needs to hook into the wider company strategy. If the company strategy doesn’t exist, or is set out as a set of goals rather than a structured diagnosis and guiding policy, a product leader can create a kernel themselves, then write the product strategy in that context. The kernel should be based on information gathered within and beyond the organisation. It should be shared with other leaders to ensure it’s aligned with wider organisational concerns.

The diagnosis and guiding policy create a frame for the coherent actions of the product strategy, which can be set out using PandA.

PandA - a refresher

The PandA framework for product strategy emphasises experimentation and measuring impact. It empowers teams to create evolving roadmaps, accepting that we can’t have absolute confidence about future outcomes. It does this by splitting the cone of uncertainty into a number of phases:

Appraise: measure the impact of what’s already been shipped

Promised: deliver on priorities in the coming weeks

Prioritise: make informed choices about work for the coming months

Potential: test hypotheses and run experiments for work you might deliver 6-12 months out

Possible: brainstorm and explore ideas for where you might be in more than 12 months

The framework enables discovery and innovation while maintaining strategic alignment and preserving team autonomy.

You can read about the framework in detail here, and how it dovetails with Sales and Marketing here.

Coherent PandAs

The PandA framework works best when it operates within a clear strategic context. However, company-level issues often need to be resolved in order to create a cohesive product strategy.

Drafting a diagnosis and guiding policies permits a product vision that balances the needs of the company, the user, the customer (in B2B), and employee experience. Market and industry research can form the basis of an initial diagnosis. This can then be refined based on interviews with leaders in the company and elsewhere, so that the guiding policies emerge.

Using PandA, a product leader can set coherent actions, tracking their effectiveness in treating the diagnosis, and continuously checking alignment with guiding policies.

Let’s step through the framework and show how using it for coherent actions results in a cohesive strategy.

Appraise - what’s already in the market?

Where the company already has product in the market, it’s important to evaluate current positioning, observe customer interaction, gather usage data and/or complete user interviews. These data, along with analysis of competitors’ products and customers’ preferences, form the basis of the diagnosis, as well as generating potential and possible coherent actions, as per the cycle above.

Timeline to delivery

Now

Sample coherent actions or inputs to diagnosis

Interview users and prospects

Inspect usage patterns

Review market feedback

Monitor competitor offerings

Promised - what’s being delivered now and next?

What’s currently being developed should clearly fit with the guiding policy, or test a hypothesis related to it. This is the next set of experiments or solutions promised to address one of the problems identified in the diagnosis.

Timeline to delivery

Coming weeks

Sample coherent actions

Complete design workshops

Deliver new product or complete experiments

Test marketing messages for new or improved functionality

Prioritise - making choices

Looking slightly further ahead, what are the next set of problems that are likely to be prioritised? Prioritisation decisions are shaped by the guiding policies, information that arises from coherent actions, particularly those relating to the potential phase

Timeline to delivery

Coming months

Sample coherent actions

Dependency mapping workshops

Documenting use cases

User testing against prototypes

Go-to-market planning

Potential - inspecting possible futures

Further out, there are the potential futures that could result from the work that is being completed and prioritised. Coherent actions to plan for these potential outcomes include reviewing the four big risks (Value, Viability, Feasibility and Usability) and which of the possible things to investigate further.

Timeline to delivery

6 - 12 months

Sample coherent actions

User segmentation and testing

Product research

Possible - starting at the end

As the cone of uncertainty widens in the longer term, detailed planning has diminishing returns. Coherent actions centre around brainstorming about the possible outcomes from the work completed in the other phases, and what the company could do next. The funnel for ideas should be wide, taking in market and sales feedback, strategy discussions, customer interviews, and anywhere else that may hold valuable information.

Timeline to delivery

12-months-plus

Sample coherent actions

Ideation

Test assumptions

Market research

Phasing your coherent actions

Using PandA to lay out coherent actions enables rapid feedback loops that check for traction and to guard against drift. Let's see how this might work in practice with a fictional scenario.

A worked example

P&A Utilities are a successful energy market business with a B2B SaaS product. They hire a new Chief Product Officer (CPO) as part of an effort to pivot their product strategy. While they have OKRs in place, they don’t follow the kernel approach. Working in partnership with the CEO, she takes the opportunity to influence a re-shaping of company strategy in line with the kernel.

P&A Utilities have a mature position and sustained success in energy management software for businesses. Given that their market is low-margin and complex, there’s a limited threat of new market entry. The market is forecast to grow by 10% per annum for the next ten years, and she assumes that demand for P&A’s core product will grow more or less in line with the market.

P&A Utilities has recently acquired new investment and plans to move into adjacent markets in order to achieve accelerated growth. This will potentially lead to acquisitions of other companies as well as new product development.

Analysing the above circumstances and interviewing key customers, the CPO and CEO formulate the following diagnosis in partnership with executives and board members.

Diagnosis

P&A Utilities needs to maintain its leading position in energy management technology while adapting to shifts in the market and technology. It currently holds a technical advantage and market position that have given it a strong brand name within the industry. Disruption is likely to come in the form of AI and AI-driven software solutions

To achieve further growth, P&A Utilities can leverage its advantages in adjacent markets, offering existing and new customers additional energy services, with a focus on AI enablement. This will be driven by acquisition and by entering those markets with new products. Moving beyond the core offering will present challenges to maintaining a coherent strategy and clear prioritisation across a growing portfolio. A substantial re-organisation of the product team and its goals will be called for.

Guiding policies

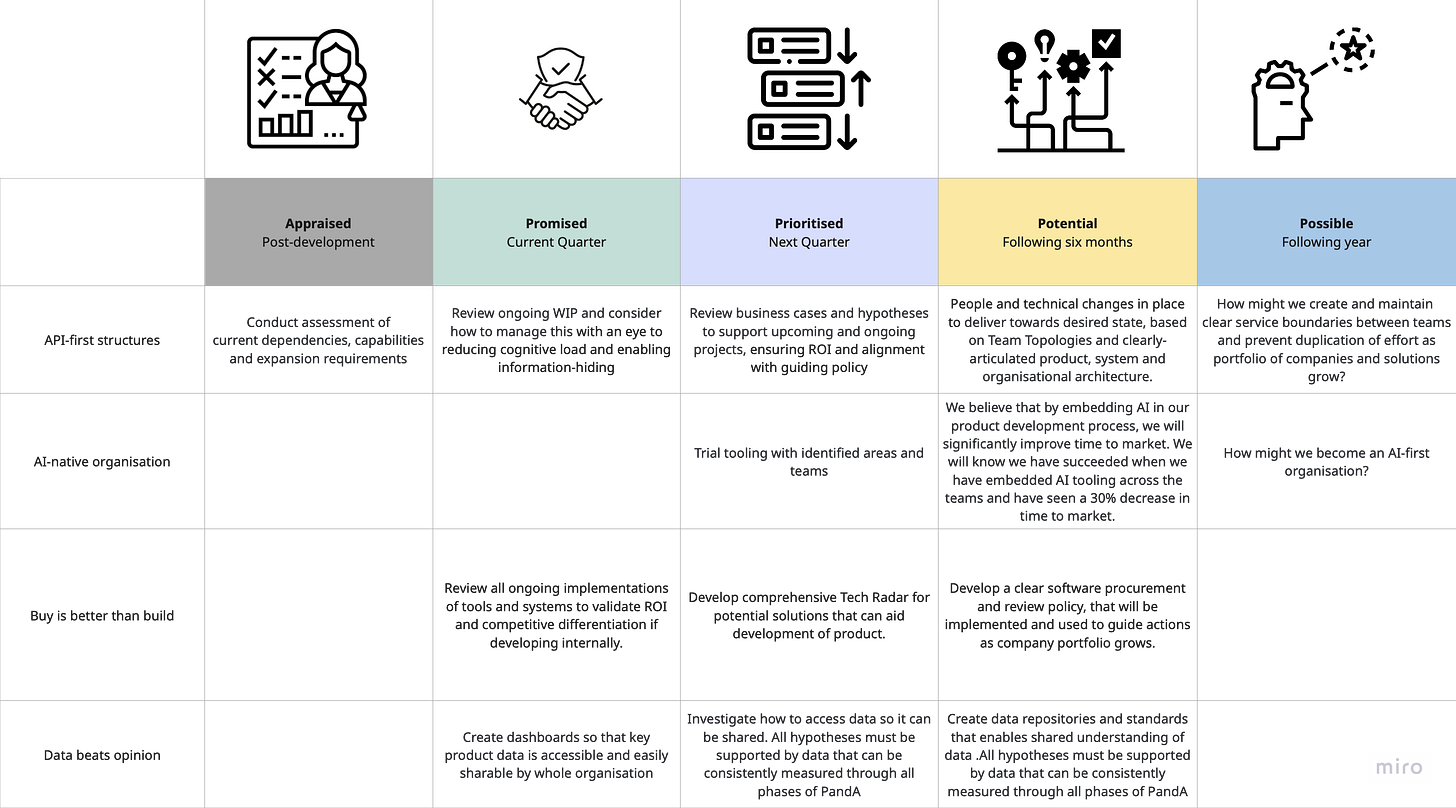

Based on this diagnosis, the CEO, CPO and the executive team formulate four guiding policies that will guide the organisation for the following eighteen months.

API-first structures

AI-native organisation

Buy is better than build

API-first structures

The first guiding policy is to create an API-first culture. All products and services will be available as APIs for internal and external consumption. Teams will operate and interact via Team APIs, requiring a business and product re-organisation that will set P&A Utilities on the path to future success.

AI-native organisation

Within P&A Utilities, there are multiple opportunities to experiment with AI, building it into the product, but also to augment human efforts and to reduce the time it takes to get from an idea to a fully-validated, delivered product. AI investments will be fast-tracked and training will be offered widely for people to transition their workflows to AI.

Buy is better than build

As noted above the company is on a growth-by-acquisition trajectory. Building on this, the Director of Engineering suggests a guiding policy should be to buy any software that does not yield competitive advantage instead of building it. This acquisition-first mentality values rapid response and accepts that there may be integration challenges. Rapid implementation is favoured, with a focus on Total Cost of Ownership.

Data beats opinion

The final guiding policy states that the company must become data driven, tracking relevant metrics, such as product adoption, WAU growth, change failure rate, etc. Broader business metrics such as profitability will be shared with the entire organisation. By ensuring that data is tracked, shared and analysed, P&A Utilities will operate following the scientific method, seeking to validate any assumptions and to ensure any mis-steps are taken as cheaply as possible.

Coherent actions

These guiding policies give rise to a set of coherent actions for different phases of the PandA framework as set out in the image below. The team works on each of these coherent actions according to the priorities set.

Appraised

The coherent actions need to include a validation of what exists today fits with the guiding policies, e.g.

What products are currently being supported?

How are the teams currently structured?

How are dependencies managed?

Using this data, the CPO can ensure that the diagnosis takes account of internal and external forces, and identify the correct coherent actions.

Promised

The CPO reviews current Work-in-Progress (WIP) with her team, and formulates an understanding of how work is delivered. She begins to form hypotheses on how this can be improved to align with the guiding policies.

Prioritised

The CPO forms an AI committee, with each executive responsible for completing some trials and POCs for AI tooling in their area, so that investment in promising technology can swiftly scale. Engineering plot a Tech Radar so that a coherent approach to software development and management can be integrated with the product portfolio approach that will be required by acquisition.

Potential

As the results of the shorter-term coherent actions become known, the CPO and executive team will also need to start working toward some longer-reaching changes, such as a re-organisation of the product function to support the new strategy.

Possible

Further out, the CPO can see that there are many questions to be asked, particularly around a successful portfolio and acquisition initiative when a number of targets have yet to be identified. She decides that ensuring that a clear set of qualification criteria for all partnerships will be a critical piece of work that will help de-risk the longer-term uncertainty.

This all sounds great, but…

While this approach can be highly effective, any organisational change faces challenges. A new CPO or executive may have the ability to influence product or business direction. An existing voice is likely to face more resistance. Here are some concerns that may be raised, along with suggestions of how to address them.

Why do we need a diagnosis?

Some organisations, particularly those that are currently successful or have personality-driven leadership, may resist the kernel of good strategy approach. If there’s no appetite for strategic insight, you may struggle to get this approach off the ground. In these circumstances, it may be best to focus on the nearer-term phases of the PandA framework and growing from there. There’s little to be gained in a full-frontal assault on “the way we do things around here.” Strategy by stealth is better than no strategy at all.

Competing frameworks

Where there are already goal-setting frameworks in place, it can be difficult to persuade leadership to move to another. Sometimes you can complete an experiment or pilot with a team, and demonstrate your results. If this is not possible, it may be worth attempting to formulate the diagnosis, guiding policy, and coherent actions as OKRs or whatever goal-setting framework enables you to deliver.

Timing is everything

Leadership may claim there's no time for diagnosis when the market is moving fast. Your team may already be operating at full capacity, and see this as an additional burden. You can make the case that using this approach to reduce work-in-progress and taking a more proactive stance will create more capacity. If there’s prolonged resistance, try to find a team to pilot with. If you can, adopt PandA in your area, and present success to leadership once you’ve embedded it. It can be difficult to make people give up something they believe works unless you can demonstrate the alternative is better.

Guided by who?

Sometimes, guiding policies will cross organisational boundaries, or may even lead to coherent actions that raise difficulties for different departments. For example, a guiding policy of “zero user friction” could lead a Product Manager to make it easier for a customer to cancel their contract, impacting potential revenue or finance goals. The same guiding policy could give rise to “white-glove” services that create additional burdens for customer service, conflicting with their efficiency goals. Where such dilemmas or differences arise, it is best to surface them quickly and have a clear decision made on which to prioritise.

Planning cycles vs PandA cycles

Many organisations do planning once a year. Some public companies struggle to look further forward than the current quarter, and the need to post positive market updates. PandA explicitly encourages explicit ongoing planning and alignment to guiding policies. This means that you may end up presenting back up a vertical slice or two of PandA for the purposes of presenting your plan to senior leadership. However, your team and your customers are likely to prefer the shorter feedback loops and responsiveness to new information offered by PandA. This is less a friction than an inconvenience.

Product can fill the strategy gap

The combination of the kernel of good strategy and PandA's structured approach empowers product leaders to drive the organisational strategy, particularly where one is currently lacking. Strategic thinking doesn't have to be the preserve of the C-suite. With structured frameworks like the strategic kernel and PandA, product leaders can create the organisational direction their companies need to succeed. So, if you see a chance to fill the strategy gap, step up.